Nigerians behind CBEX scam revealed

The identity of Nigerians behind CBEX digital platform that defrauded many Nigerians have been exposed.

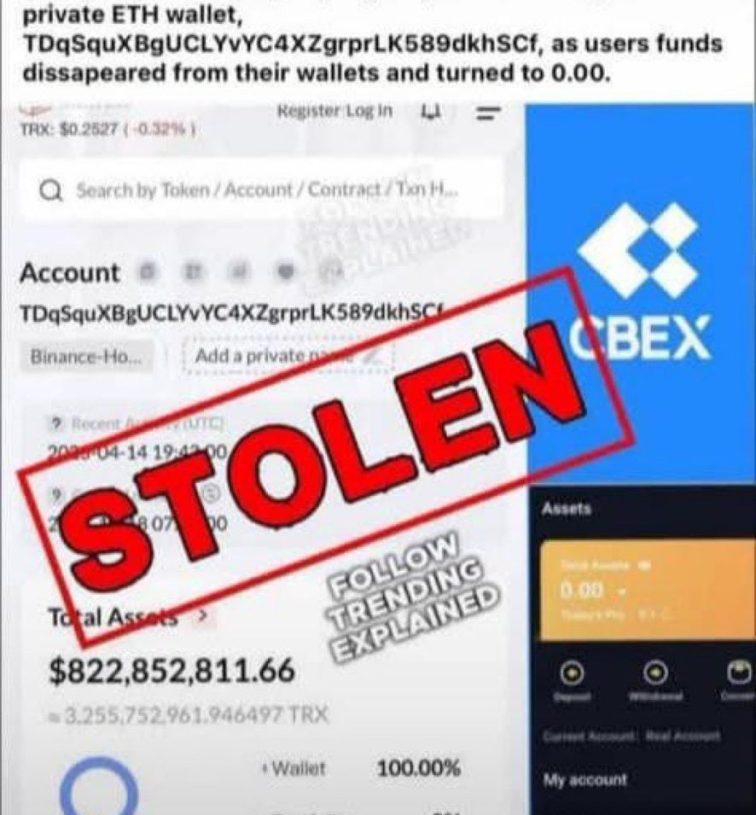

What many saw as a fast track to wealth has ended in financial ruin for thousands of Nigerians who invested in CryptoBridge Exchange (CBEX), a now-defunct cryptocurrency investment scheme.

The fraudulent platform, which masqueraded as a legitimate digital asset exchange, reportedly collapsed in April, locking out investors and vanishing with an estimated N1.3 trillion.

Early signs of the collapse were noticed when investors could no longer access their profiles, signaling they had been locked out without warning. Despite initial skepticism, it became clear that CBEX had crumbled, leaving behind heartbreak, confusion, and financial devastation.

CBEX operated in Nigeria under the guise of ST Investment Co., Ltd, reportedly owned by 55-year-old British national Harold David Charles. Through strategic media publications in late January, Charles was introduced to the Nigerian public as an investment guru. These publications emphasized a supposed partnership between ST Investment and CBEX, claiming the alliance would offer a safe and efficient digital asset environment.

While CBEX itself was never registered in Nigeria, it was floated by ST Technologies International, which held a Corporate Affairs Commission (CAC) registration and an anti-money laundering certificate from EFCC’s Special Control Unit Against Money Laundering (SCUML). Other affiliated names included Smart Treasure and Super Technology—interestingly, all sharing the initials “S.T.”

Prominent among CBEX’s local promoters were Adefowora Abiodun and Oluwanisola Adefowora, suspected to be either siblings or a couple. They spearheaded campaigns and seminars encouraging Nigerians to abandon salaried jobs and invest in CBEX.

Other figures associated with the scheme included Seyi Oloyede, Emmanuel Uko, and Victor Solomon—who was named team lead in a promotional video but has since gone incommunicado.

Targeting Schools and Gaining Public Trust

Beyond hotel seminars and roadshows, CBEX promoters sought public trust through sponsorships. On February 10, the scheme sponsored an inter-house sports event at MAXFEM International Schools, Lagos. The school’s “Yellow House” was renamed “ST CBEX House” in exchange for a N400,000 sponsorship.

Speaking to reporters, the school’s owner, Olufemi Stephen Oguntola, said he had no prior knowledge of CBEX. The connection was facilitated through a friend, who himself reportedly lost $10,000 to the scheme. Oguntola admitted to not conducting any background checks before accepting the sponsorship.

The sponsor, identified as Temitayo Oke from Ibadan, has since gone underground. His phone has remained unreachable, and he has not responded to calls or messages.

As the investigation continues, the CBEX collapse serves as a stark reminder of the risks associated with unregulated investment platforms, particularly in the fast-evolving crypto space. Regulatory agencies urge the public to verify the legitimacy of any financial investment with authorized bodies before committing their funds

How I met my Tanzanian husband – Priscilla Ojo

Bloody Friday: 17 killed in fresh attack on Benue communities

CBEX: Why Nigerians will always fall for Ponzi schemes

Share your story or advertise with us: Whatsapp: +2348033202396 Email: sentinelnewsng@gmail.com