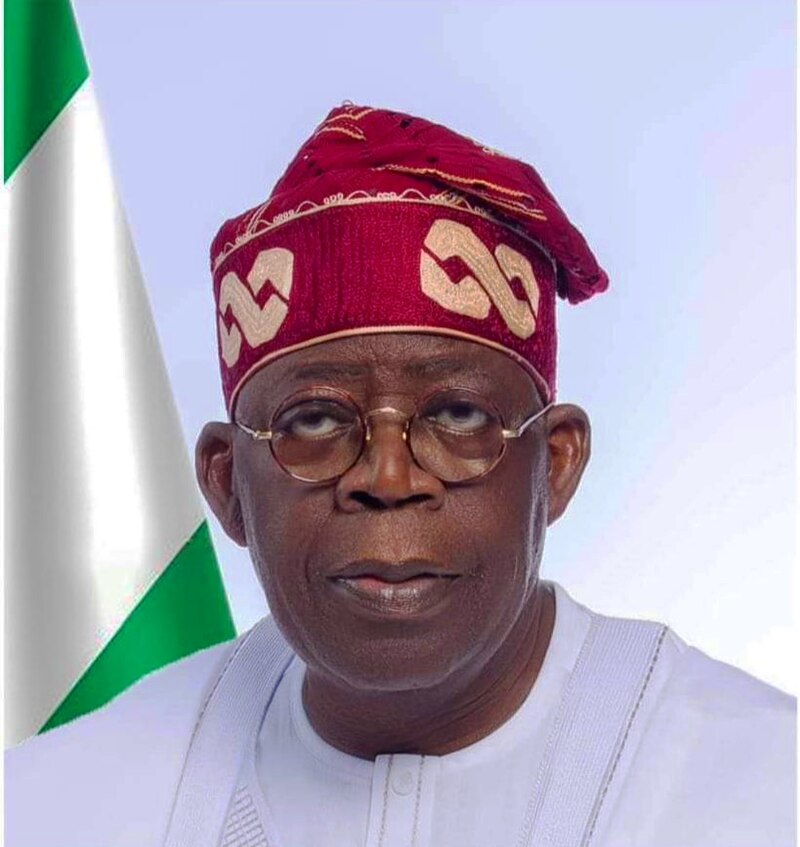

While President Bola Tinubu’s administration secured approval to borrow an additional N1.15 trillion from the domestic market this week, ordinary Nigerians continue to shoulder the consequences of a staggering N152.39 trillion national debt that shows no signs of slowing down.

The new borrowing, approved by the National Assembly on Tuesday, comes despite Tinubu’s recent declaration that Nigeria had stopped taking loans from local banks.

The government stated the funds are needed to cover a deficit created when lawmakers increased the 2025 budget size.

However, this latest loan only adds to a debt burden that has reached alarming proportions. Official data from the Debt Management Office reveals Nigeria’s total public debt climbed to N152.39 trillion as of June 2025, a figure that translates to approximately N700,000 for every Nigerian citizen.

While President Bola Tinubu’s administration secured approval to borrow an additional N1.15 trillion from the domestic market this week, ordinary Nigerians continue to shoulder the consequences of a staggering N152.39 trillion national debt that shows no signs of slowing down.

The new borrowing, approved by the National Assembly on Tuesday, comes despite Tinubu’s recent declaration that Nigeria had stopped taking loans from local banks.

The government stated the funds are needed to cover a deficit created when lawmakers increased the 2025 budget size.

However, this latest loan only adds to a debt burden that has reached alarming proportions. Official data from the Debt Management Office reveals Nigeria’s total public debt climbed to N152.39 trillion as of June 2025, a figure that translates to approximately N700,000 for every Nigerian citizen.

The real impact of this mounting debt is felt not in parliamentary debates but in the daily lives of citizens. As debt servicing consumes an increasing portion of government revenue, less funding remains for essential services that affect ordinary people.

Healthcare facilities struggle with inadequate funding, classrooms remain overcrowded, and infrastructure projects stall – all while the nation’s debt obligations continue to grow.

Deepening Debt, Deteriorating Welfare

The new loan adds to Nigeria’s total public debt, which stood at N152.39 trillion as of June 30, 2025, a figure that has drawn concern from economic experts. Dr. Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprises (CPPE), acknowledged that exchange rate depreciation has significantly inflated the debt value, but maintained that continuous borrowing without visible developmental outcomes remains troubling.

More pressing, however, is the real-life implication for ordinary Nigerians. Despite the removal of fuel subsidy in 2023, a measure intended to boost government revenue, many citizens report no corresponding improvement in public services or economic relief.

Dr. Wasiu Olasunkanmi Lawal, an economist with Al-Hikmah University, Ilorin, captured the public mood, stating, “If we say we now have more money after subsidy removal, why are we still borrowing? Where is the money going? Nigerians have been buying petrol at high prices since 2023, yet there’s no visible fiscal balance.”

Transparency and Accountability Deficits

Umar Yakubu, Executive Director of the Centre for Fiscal Transparency and Public Integrity (CEPTI), described the timing of the loan as “suspicious,” noting that the government has yet to commence serious capital project implementation for the year. He also criticized the National Assembly for routinely approving borrowing requests without rigorous scrutiny.

The lack of transparency extends to recovered funds, with Dr. Lawal pointing out that monies retrieved by agencies like the EFCC are rarely accounted for in a manner that benefits public welfare.

“When the EFCC said it recovered N80 billion, where did that money go?” he asked. “These are monies that could be channelled into education, healthcare, and social welfare.”

Mortgaging the Future

With domestic debt now at N80.55 trillion and external obligations at $46.98 billion, Nigeria’s debt servicing costs continue to divert resources away from critical sectors like health, education, and infrastructure. Dr. Lawal warned that the country is falling into a “deficit trap,” with borrowing increasingly outpacing revenue generation. “Continuous borrowing means the future of the country is being mortgaged,” he said. “The amount being borrowed today may not be repaid in several generations.”

He further likened the nation’s economic direction to “a vehicle being driven at night by a drunk driver with deflated tires and no headlights,” emphasizing the absence of a clear and sustainable fiscal strategy.

A Call for Prudence

As the government continues to borrow amid a worsening cost-of-living crisis, economists are urging a return to fiscal discipline, transparency, and citizen-focused budgeting. Until then, each new loan approval deepens the debt burden—and further distances the promise of prosperity from the reality of the average Nigerian.

Economist Dr. Wasiu Olasunkanmi Lawal captured the concern of many experts, warning that “continuous borrowing means the future of the country is being mortgaged.” He questioned the government’s fiscal discipline, noting that despite claims of improved revenue from measures like subsidy removal, Nigerians see little evidence of these benefits in their daily lives.

The situation creates a vicious cycle: as more funds are allocated to service existing debt, less money is available for development projects that could stimulate economic growth and ultimately generate the revenue needed to reduce borrowing.

With the latest N1.15 trillion loan approval, the Tinubu administration has signaled that debt remains a primary tool for funding government operations – ensuring that the weight of the N152 trillion debt burden will continue to press heavily on Nigerian citizens for the foreseeable future.

- PDP Convention in Limbo as Court Defers Judgment on Lamido’s Suit

- “No Genocide in Nigeria,” African Union Chief Counters Trump

- Don Jazzy Honors Wande Coal As Nigeria’s Top Vocalist, Sparking Fan Debate

Share your story or advertise with us: Whatsapp: +2348033202396 Email: sentinelnewsng@gmail.com